Let’s talk about credit cards! They’re the plastic items that make shopping easy and reward you for spending. If you aren’t getting points or cashback yet on all your purchases, you’re missing out! With so many options available, it can be difficult to find the right one. But don’t worry, we’re here to help! We’ll present the best credit cards that offer cashback rewards for your everyday purchases, with no annual fees. Below are the top 5 most popular cashback credit cards, with their respective advantages and disadvantages to consider.

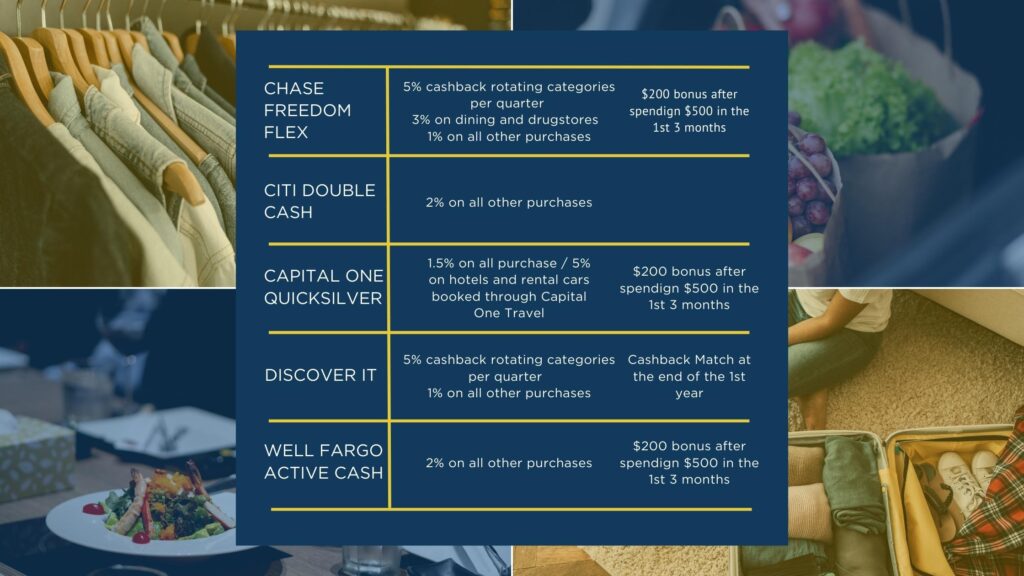

Chase Freedom Flex

- 5% cashback on up to $1,500 in combined purchases in bonus categories each quarter

- 1% cashback on all other purchases

- $200 bonus after spending $500 in the first three months of opening the account

Pros:

- High cashback percentage in bonus categories

- Generous sign-up bonus

- Offers a range of perks, such as extended warranty protection and purchase protection

Cons:

- Bonus categories change every quarter, so rewards can be unpredictable

- Foreign transaction fee

Chase Freedom Flex card is a great option for everyone to start out with. With the Freedom Flex card, you can earn 5% cashback on up to $1,500 in combined purchases in bonus categories each quarter, and 1% cashback on all other purchases. The rotating categories is usually a turn off for veteran card holders but great for beginners as they see how much they accumulate with their spending also forcing them to keep an eye on their spending.

The best part – new cardholders can earn $200 after spending just $500 in the first three months of opening the account.

Citi Double Cash

- 2% cashback on all purchases

- No category restrictions or limitations on cashback earnings

Pros:

- No category restrictions or limitations on cashback earnings

- Simple and straightforward rewards system

- Provides access to Citi Entertainment, which offers exclusive access to events and pre-sale tickets

Cons:

- No sign-up bonus

- Foreign transaction fee

The Citi Double Cash credit card is an excellent option for those who want to earn cashback on all purchases and those who close out each balance at the end of the month. Cardholders can earn 2% cashback on every purchase they make – 1% cashback when they make a purchase and an additional 1% cashback when they pay their bill. This is an excellent card to teach new credit card holders to pay off their balance each month. There are no category restrictions or limitations on the cashback that can be earned, making it a great choice for everyday spending.

Capital One Quicksilver Cash Rewards

- 1.5% cashback on all purchases

- No category restrictions on cashback earnings

- $200 bonus after spending $500 in the first three months of opening the account

Pros:

- No category restrictions on cashback earnings

- Provides access to Capital One’s CreditWise tool, which helps monitor your credit score and report

- No foreign transaction fees

Cons:

- Lower cashback percentage compared to other cards

- No bonus categories for higher cashback earnings

- No sign-up bonus

The Capital One Quicksilver Cash Rewards credit card is a straightforward cashback credit card. Cardholders earn 1.5% cashback on every purchase they make, and there are no restrictions on the categories that qualify for cashback rewards. As for the signing bonus, similar to Chase Freedom Flex, new cardholders can earn a $200 cash bonus after spending $500 in the first three months of opening the account.

Discover it Cash Back

- 5% cashback on up to $1,500 in quarterly rotating categories

- 1% cashback on all other purchases

- Cashback match on all rewards earned in the first year of the account opening

Pros:

- High cashback percentage in rotating categories

- Cashback match on all rewards earned in the first year of the account opening

- No foreign transaction fee

Cons:

- Bonus categories change every quarter, so rewards can be unpredictable

- Cashback match only applies to the first year of the account opening

The Discover it Cash Back credit card is similar to Chase Freedom Flex with it’s rotating categories. Cardholders can earn 5% cashback on up to $1,500 in purchases in quarterly rotating categories, and 1% cashback on all other purchases. One unique perk with the Discover It Cash Back is that they match all the cashback earned by cardholders in the first year of the account opening, effectively doubling the rewards earned.

Wells Fargo Active Cash

- 2% cashback on all purchases

- No category restrictions on cashback earnings

- $200 cash reward after spending $1,000 in the first three months of opening the account

Pros:

- No category restrictions on cashback earnings

- No foreign transaction fees

- No sign-up bonus

- Cell phone protection

Cons:

- No bonus categories for higher cashback earnings

- Required to Spend $1000 to get $200 sign-on bonus unlike other credit cards that require only $500.

Similar to Capital One’s Quicksilver card, the Wells Fargo Active Cash credit card is a straightforward cashback card. Cardholders can earn an unlimited 2% cashback on every purchase they make which is .5% higher than the Capital One Quicksilver card. For the sign-on bonus, new cardholders can earn a $200 cash reward after spending $1,000 in the first three months of opening the account.

In conclusion, each of these credit cards offer rewards on everyday spending without requiring an annual fee. It’s important to consider the cashback percentage, restrictions, and benefits that each card offers to choose the one that best suits your spending habits. Keep in mind that each card has its own set of pros and cons, so make sure to weigh them carefully before making a decision.

In conclusion, finding a credit card that offers rewards on everyday spending without an annual fee is a great way to maximize your spending. By considering the cashback percentage, restrictions, and benefits of each card, you can choose the one that best suits your spending habits. Keep in mind that each card has its own pros and cons, so it’s important to weigh them carefully before making a decision.

So, which card are you going for? Take the time to consider your options and choose the one that works best for you.